The US Federal Reserve’s upcoming policy meeting on December 18, 2024, has garnered significant attention as the central bank is expected to announce a 25-basis-point rate cut. This will mark the third consecutive reduction in rates, bringing the federal funds rate to a range of 4.25% to 4.5%. While the decision is important for global markets, its potential impact on the Indian stock market cannot be overlooked.

Key Highlights from the US Fed Meeting

- Interest Rate Cut: The Federal Reserve is likely to lower its benchmark interest rate by 25 basis points, signaling a shift toward easing monetary policy. This move comes after a series of strong economic indicators, including robust retail sales and steady inflation figures.

- Economic Growth: Despite inflation pressures, the US economy remains resilient, with November retail sales rising by 0.7%, surpassing October’s growth of 0.5%. However, inflation remains stubbornly high, causing the Fed to adopt a more cautious approach to future rate cuts.

- Market Expectations: Markets have priced in the probability of the rate cut, with the CME Group’s FedWatch tool indicating a 99% chance of the 25 basis-point reduction. The focus will shift toward future rate cuts, with economists forecasting more gradual easing in 2025.

Will This Affect Indian Markets?

1. Global Market Sentiment

The Indian stock market is highly sensitive to global economic developments, especially in the US. A rate cut by the US Federal Reserve generally strengthens global risk appetite, pushing investors toward riskier assets, including emerging markets like India. Therefore, we might witness a positive sentiment in the Indian stock market on December 18, 2024, with capital inflows potentially boosting Indian stocks.

2. Currency and Inflation Outlook

The US rate cut is expected to influence the strength of the US dollar. A weaker dollar could make Indian exports more competitive, especially in sectors like IT, pharmaceuticals, and textiles. However, inflation remains a critical concern in both the US and India. While a rate cut can support economic growth, it also raises inflationary risks, which could impact Indian monetary policy and corporate profitability.

3. Impact on the Indian Rupee

The Indian Rupee could experience some depreciation if the Fed’s actions lead to a weaker dollar. While this could be a boon for exporters, it may increase the cost of imports, particularly oil and gold. The currency dynamics could affect sectors like oil and gas, as well as infrastructure.

4. Sectoral Performance

- Technology Stocks: The Indian IT sector, which is heavily influenced by US demand, may benefit from the US rate cuts. A stronger global economy can lead to higher spending on IT services, benefiting companies like TCS, Infosys, and HCL Technologies.

- Banking and Financials: A US rate cut might influence Indian banks’ lending rates and overall credit growth. While banks could face margin pressures, lower global rates might support loan demand.

- Export-Oriented Sectors: Companies in sectors like pharmaceuticals, textiles, and engineering that depend on exports may gain from a weaker US dollar, which improves their price competitiveness.

Expected Short-Term Market Movements

Given the positive sentiment surrounding the rate cut, Indian stocks could see an initial uptick following the US Fed’s announcement. However, investors will remain cautious and focus on Jerome Powell’s remarks and any signals about the Fed’s future stance, especially for 2025.

Here’s a quick snapshot of how the Indian stock market could react based on historical trends and key economic factors:

| Factor | Expected Impact on Indian Stock Market |

|---|---|

| US Fed Rate Cut | Likely to boost global risk appetite and attract foreign inflows into Indian stocks |

| US Dollar Weakening | Positive for export-heavy sectors like IT, pharmaceuticals, textiles |

| US Inflation | Concerns about inflation could lead to volatility in sectors sensitive to global price changes |

| Global Economic Growth | Likely to support demand for Indian exports and IT services |

| US Economic Indicators | Strong US economic performance could boost investor confidence in Indian markets |

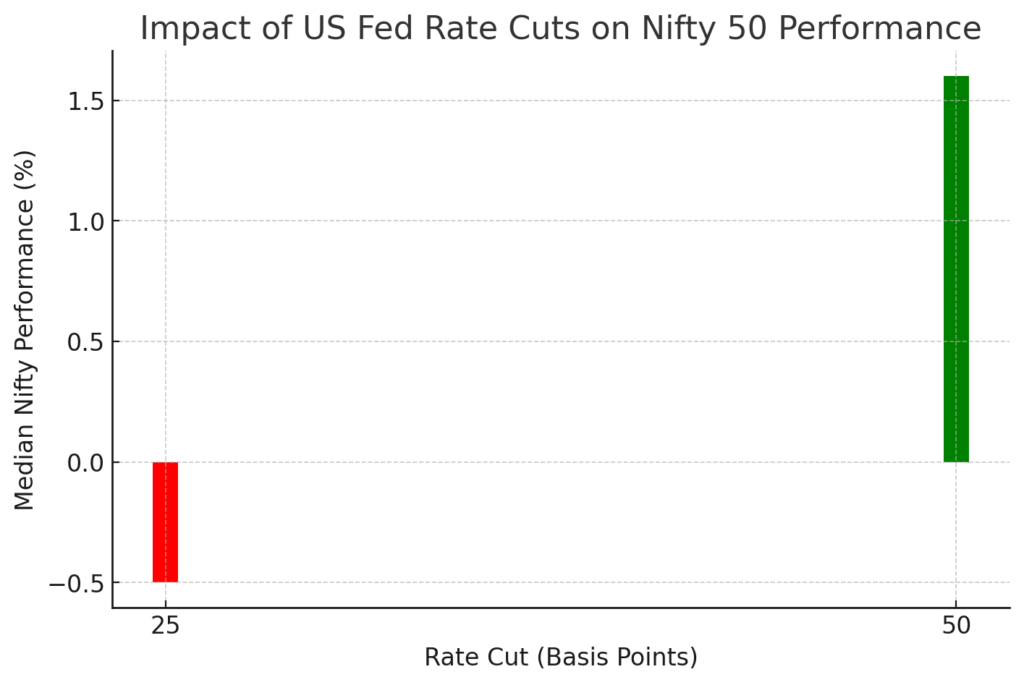

Chart: Indian Stock Market vs. US Rate Cuts (Historical Trends)

(This chart highlights how the Indian stock market has historically reacted to US rate cuts)

Implications for India:

- Positive Impact of Larger Cuts: A larger rate cut from the US could drive more foreign investment into Indian markets, boosting stock prices.

- Cautious Market Reaction to Smaller Cuts: The market may show signs of caution with smaller rate cuts, reflecting the uncertainty around the Fed’s long-term monetary policy and the impact of inflation in the US.

Given that the US Fed is expected to announce a 25 bps rate cut on December 18, 2024, this historical data suggests that the Indian stock market may experience a cautious reaction, potentially leading to a small dip in stock prices. However, investors should also consider other factors, such as the global economic outlook and local developments, that could influence the market beyond just the Fed’s decision.

Conclusion: What to Expect on December 18, 2024

The US Federal Reserve’s anticipated rate cut is likely to positively impact the Indian stock market, particularly in sectors that benefit from global growth and a weaker US dollar. However, market participants should be prepared for volatility, especially if the Fed provides any hints regarding future rate cuts or changes in its policy stance. Investors should keep an eye on Jerome Powell’s remarks for further clues on the US economic outlook and how it could influence Indian markets in the coming months.

For more updates on stock market trends, investment strategies, and economic analysis, stay tuned to FinGuys.

Disclaimer: The content above is for informational purposes only and does not constitute financial advice. Always do your research before making investment decisions.